Insurance Claims Appraisal Dispute Resolution

TOP RATED INSURANCE APPRAISER

FLORIDA INSURANCE APPRAISAL FOR INSURANCE CLAIM DISPUTES

When a home or business is damaged and the claim reaches an impasse, the appraisal process included in most commercial and residential insurance policies can serve as an alternative dispute resolution method to avoid expensive and time consuming litigation or at least resolve portions of the claim.

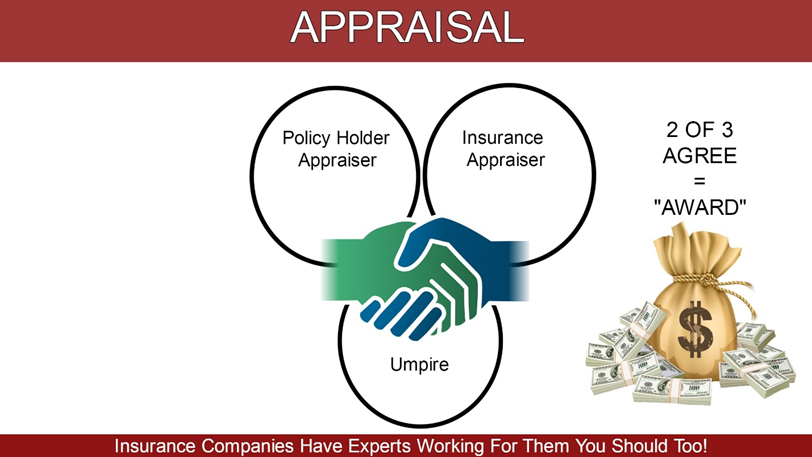

It is the job of an appraiser to assess and evaluate the damage and provide an impartial, informed estimate of the value of the loss. The policyholder and the insurance company both will have their own independent appraiser assess the damage, and if the two appraisers cannot agree then a third appraiser will be used to resolve the differences. The third appraiser is called an umpire and is either agreed between the appraisers or appointed by a court having jurisdiction. Appraisal boils down to an agreement of two of the three appraisers. (SEE BELOW)

Understanding the Appraisal ProcessTypically, insurance companies include an appraisal or arbitration clause in every policy. The clause stipulates that in the event that the property owner and the insurance company cannot agree on the value of the loss, either party may demand an appraisal and, in some occasions, that both parties must agree to enter into an appraisal.Each party selects an appraiser and the two appraisers — one from the policyholder and one from the insurance company — work together to agree on the value of the damaged property. A mutually agreed-upon or court-appointed umpire will handle any disputes between the appraisers, and any agreement signed by two of the three parties will set the value of the loss. Arbitration is similar except that instead there is a panel of arbitrators that form the position of the umpire in appraisals and the lawyers or advocates for the parties present to the sometimes one person sometimes three panel of arbitrators.

![]()

Serving Florida as a top rated Insurance Appraiser - We are A+ Rated Insurance Appraisers

Pros & Cons

Appraisal vs Lawsuit

| Appraisal | Lawsuit |

|---|---|

Quick - Expedient |

Slower – protracted |

Relatively less costly |

Generally more costly |

May be less adversarial |

More adversarial |

No appellate potential |

Appeal is possible |

Must pay fees/costs |

May recover fees/costs |

No firm procedure |

Strict procedures |

The Alternative Dispute Resolution Process

Rather than engaging in prolonged and expensive litigation, this alternative dispute resolution process can save both parties significant money and time. Complete has a long-standing record serving as the appraiser for homeowners and insurance companies, as well as the umpire in disputes between the parties.

Whether the damage is due to fire, flood, wind storm, hail or other natural phenomena, Complete has the experience working on residential, commercial, and industrial properties from every angle to know how to resolve discrepancies and disagreements. We are intimately familiar with the actual time and realistic costs of materials it takes to bring a property back to its original state.

How does the Insurance Appraisal Process Work?

Rather than engaging in prolonged and expensive litigation, this alternative dispute resolution process can save both parties significant money and time. Complete has a long-standing record serving as the appraiser for homeowners and insurance companies, as well as the umpire in disputes between the parties.

Whether the damage is due to fire, flood, wind storm, hail or other natural phenomena, Complete has the experience working on residential, commercial, and industrial properties from every angle to know how to resolve discrepancies and disagreements. We are intimately familiar with the actual time and realistic costs of materials it takes to bring a property back to its original state.

The appraisal language in a HO3 policy typically reads as follows:

Appraisal. If you and we fail to agree on the actual cash value, amount of loss, or cost of repair or replacement, either can make a written demand for appraisal. Each will then select a competent, independent, appraiser and notify the other of the appraiser's identity within 20 days of receipt of the written demand. The two appraisers will choose an umpire. If they cannot agree upon an umpire within 15 days, you or we may request that the choice be made by a judge of a district court of a judicial district where the loss occurred. The two appraisers will then set the amount of loss, stating separately the actual cash value and loss to each item.

Contact National Adjusters to act as your appraiser. Once hired National Adjusters Insurance Appraisr will invoke the Appraisal clause/provision, the insured's appraiser and the insurance carrier's appraiser will estimate the damage and try to come to an agreement on the amount of loss.

If the appraisers fail to agree, they will submit their differences to the umpire. An itemized decision agreed to by two of these three will set the amount of loss. Such award shall be binding.

Each party will pay its own appraiser and bear the other expenses of the appraisal and umpire equally.

To inquire about the services of National Adjusters to act as your insurance appraiser, please fill out the form below.

USING NATIONAL ADJUSTERS AS YOUR FLORIDA INSURANCE APPRAISER PAYS

"Most Experienced Insurance Appraisers in Florida "